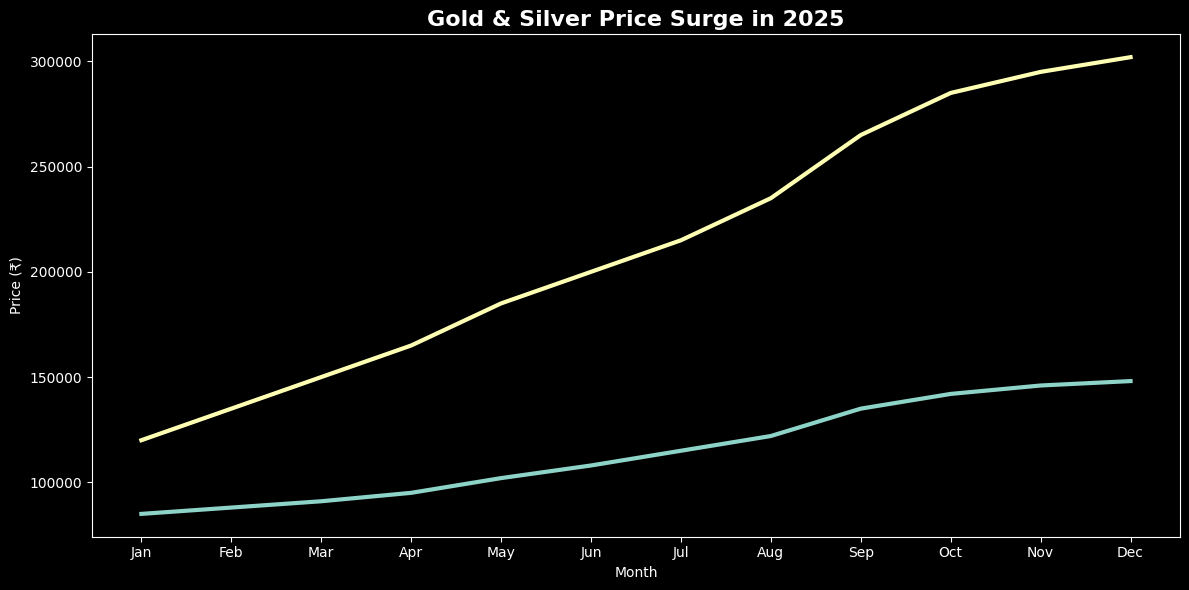

Silver prices in India surged to unprecedented levels on Monday, breaching the ₹3 lakh per kilogram milestone for the first time on strong global cues, while gold extended its rally to hit a fresh lifetime high of ₹1.48 lakh per 10 grams. The sharp rally in precious metals tracks intensifying geopolitical risks, renewed global trade tensions and sustained safe-haven demand as investors brace for market volatility.

On the Multi Commodity Exchange (MCX), silver futures closed above ₹3 lakh/kg, touching as high as ₹3,07,163, a landmark that reflects over 30% gains year-to-date. Gold futures also climbed firmly, with prices rising by nearly ₹2,000 in a single session. Analysts across the market attributed these historic moves to heightened geopolitical uncertainty, particularly fresh tariff threats by the United States against several European nations.

Trade Tensions Drive Safe-Haven Buying

Domestic price action mirrors international trends, where silver surged past $94 per ounce and gold climbed near $4,690 on global exchanges. This rally stems largely from renewed tariff rhetoric by U.S. President Donald Trump, who has threatened 10% tariffs on imports from key European countries beginning February 1, potentially rising to 25% by June unless a political agreement is reached over the U.S. bid to acquire Greenland.

The threat targeted goods from nations including Denmark, Sweden, France, Germany, the Netherlands, Finland, the U.K. and Norway, sparking concerns of a broader trade conflict. The European Union has reportedly prepared retaliatory measures totalling approximately €93 billion in response to U.S. measures.

European markets reacted sharply: key indices such as the DAX and CAC 40 posted losses, and analysts warned that escalating trade friction could weaken growth prospects across major global economies. Investors, in turn, shifted capital into precious metals as portfolio hedges, with gold and silver perceived as safe stores of value amid uncertainty.

Global Markets, Currency and Macro Signals

Beyond tariff fears, a softer U.S. dollar has further enhanced the appeal of dollar-priced commodities such as gold and silver for non-U.S. buyers. Expectations of potential interest rate cuts by the Federal Reserve, driven by slower economic data, have also underpinned upbeat momentum for bullion.

International precious metals benchmarks tell the same story: gold hit record levels above $4,700 per ounce on Tuesday before slight retracements, while silver also continued to rally beyond $95 per ounce. This marks a dramatic expansion from commodity price levels just a year ago.

Domestic Import Dynamics: Demand Despite High Prices

India, one of the world’s largest importers of gold and silver, continued to see robust import volumes in 2025 despite steep price increases. According to recent data:

- Gold imports fell 23.2% in 2025 to 623.6 tonnes, down from 812.2 tonnes in 2024.

- Silver imports also declined to 7,158 tonnes from 7,669 tonnes in the prior year.

Despite this drop in volume, the value of these imports remained high, approximately $58.84 billion for gold and nearly $9 billion for silver in 2025, reflecting the sharp ascent in prices, driven by both investment and industrial demand.

Analysts highlight that resilient import figures demonstrate strong investment interest rather than purely consumption driven by jewellery or industrial usage. Many investors have been buying bullion as a hedge against inflation and geopolitical risk, even at elevated price points.

Supply Challenges and Market Tightness

Physical markets have increasingly shown supply tightness, particularly in silver, where premiums widened due to limited availability and strong speculative buying. This physical squeeze underpins strong price momentum and suggests that both retail and institutional buyers are wary of future scarcity.

Additionally, industrial demand for silver, used heavily in electronics, solar energy components, automotive systems and other high-growth sectors, has remained robust, further tightening available stocks and supporting higher price levels. This combination of investment demand and industrial consumption distinguishes silver’s rally from typical gold price movements.

Market Implications: What Investors Should Know

For investors and market participants, the ongoing precious metals surge presents both opportunities and risks:

- Safe-Haven Appeal: Geopolitical tensions and trade policy uncertainty are likely to keep bullion attractive in the near term.

- Volatility Risks: Sharp price movements can trigger profit-taking or rapid swings, particularly in futures markets.

- Macro Influences: Central bank policies, inflation data, and currency dynamics will continue to shape gold and silver equilibrium.

Market strategists caution that while upward trends may persist, profit booking and technical corrections may occur, especially if trade tensions subside or major central banks signal tighter monetary policy.

Looking Ahead

Analysts forecasting medium-term bullion trends anticipate continued strength, but emphasize close monitoring of trade negotiations, global economic indicators, and monetary policy shifts. Should tariff hostilities deepen or contagion spread to other sectors, safe-haven flows into precious metals could intensify further. However, if diplomatic solutions emerge, markets might shift back toward risk-assets, tempering precious metal price growth.

For now, silver’s breakthrough beyond the ₹3 lakh mark and gold’s steady climb signal investor caution amid a complex global economic landscape — one where geopolitics and commodity markets are increasingly intertwined.